Transforming Empty Offices into Homes

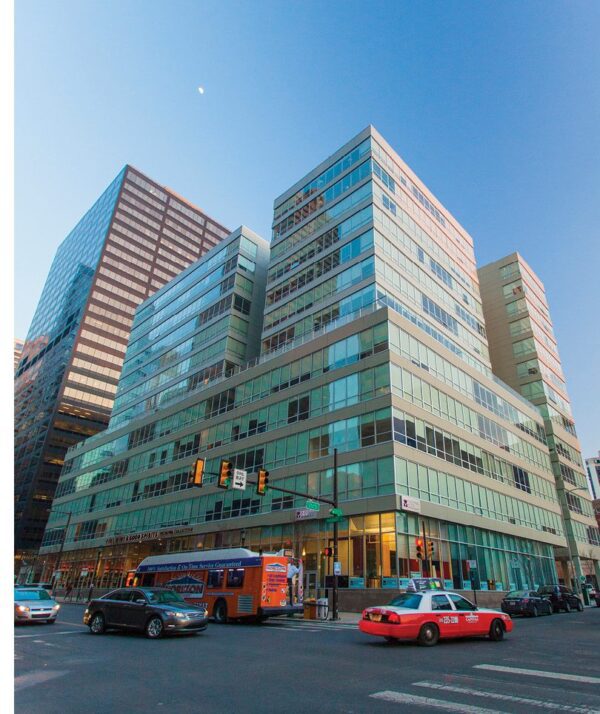

Converting empty offices to housing isn’t a new concept. As shown here, 2040 Market, the five-story concrete former headquarters for the American Automobile Association in Philadelphia, was turned into a mixed-use residential building in 2013. But renewed interest in such conversions is allowing cities to leverage existing buildings and transform them to meet today’s housing needs without having to demolish and rebuild from scratch.

Cities nationwide are exploring adaptive reuse projects to revitalize urban spaces, unlocking housing solutions and fostering environmental sustainability.

Amidst the widespread adoption of hybrid work models, the surplus of unused office space in the wake of the COVID-19 pandemic offers a potential solution to the affordable housing shortage in the United States. The Biden administration recently introduced initiatives to accelerate conversions of empty offices into affordable housing units, but it’s important to consider local incentives and restrictions as well as the physical viability of such conversions.

A Desperate Need for Affordable Housing

The societal shifts induced by the COVID-19 pandemic haven’t only altered how people live and work but also have triggered significant impacts on the commercial real estate market, particularly in the office-space sector. With a surge in remote work and reduced office attendance, the United States is witnessing a historic high in office vacancies, reaching an 18.2 percent vacancy rate in November 2023, according to a “National Office Report” released by CommercialEdge (bit.ly/3O1qgJb).

The U.S. demand for affordable housing also has reached critical levels, as detailed in the May 7, 2021, FreddieMac report “Housing Supply: A Growing Deficit.” As of the fourth quarter of 2020, the United States had a housing supply deficit of 3.8 million units, with rental vacancy rates at their lowest in decades and 45 percent of renters burdened by spending more than 30 percent of their income on housing (bit.ly/3tPZHQk). The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes, a decline that has been exacerbated by an even larger decrease in the supply of entry-level single-family homes and the effects of the pandemic. Recognizing the urgency of the housing crisis, policymakers are turning to innovative solutions, including the conversion of commercial properties to residential use.

Office-to-Residential Conversion as a Solution

In October 2023, the Biden administration released an initiative to help accelerate conversions of commercial properties to residential use, as explained in “Commercial to Residential Conversions: A Guidebook to Available Federal Resources” (bit.ly/3RUITzB). This isn’t surprising, as cities often use commercial-to-residential conversion incentives to adapt vacant office spaces during economic downturns. For example, New York revitalized Lower Manhattan after 9/11 through zoning changes, converting 20 million square feet of office space into housing and doubling the local residential population. Los Angeles, responding to the dot-com bubble, relaxed zoning for older commercial buildings, resulting in 12,000 housing units through 20 years. Similarly, Philadelphia linked conversions to 10-year property-tax abatements, converting 8.2 million square feet of office space and boosting the city center’s population by 54 percent.

Recently, cities across the country have taken steps to revitalize downtown areas by converting vacant offices, hotels and nonoffice commercial spaces. The advantages of such conversions extend beyond addressing housing shortages; they also present an opportunity to combat climate change. According to “Converting Brown Offices to Green Apartments,” an August 2023 report from the National Bureau of Economic Research, rehabilitated structures can significantly reduce carbon emissions compared to new construction (www.nber.org/papers/w31530).

Despite a slowdown in office-to-residential conversions in 2022, the outlook indicates growth based on a RentCafe analysis of Yardi Matrix data (bit.ly/47uUDP5). Office conversions in 2022 decreased by 15 percent, resulting in only 3,390 repurposed apartments. Factors contributing to this decline include uncertainty about the future of office buildings, high construction costs and zoning regulations unsuitable for residential use. Conversely, hotel-to-apartment conversions experienced a record-breaking 43 percent increase, yielding 2,954 multifamily units. As shown in Figure 1, office conversions still dominated, comprising 33.6 percent of all projects, followed by hotels at 29.3 percent. Factories, healthcare buildings and warehouses constituted 12.3 percent, 6.2 percent and 4.8 percent, respectively.

Figure 1. Top Building Types Converted to Apartments in 2022

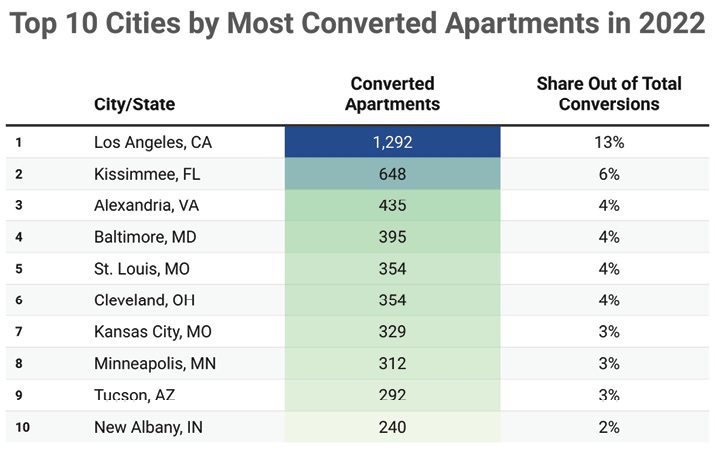

Figure 2 shows how Los Angeles led the nation with 1,292 converted apartments, contributing 13 percent of total conversions in 2022. Other top cities included Kissimmee, Fla., and Alexandria, Va. Former hotspots such as Washington, D.C., Philadelphia and Chicago dropped from the top 10 list, with smaller cities dominating.

Figure 2. Top 10 Cities by Most Converted Apartments in 2022

The trend is driven by increased office vacancies, incentivizing the revitalization of downtown areas. Office conversions can improve the financial condition of commercial landlords that are losing revenue as well as local governments which rely on property taxes to fund city services that make downtown neighborhoods appealing areas to work and live. New residents moving into recently converted housing support downtown businesses and offset lost property taxes from empty offices. Demand for housing and government initiatives to rejuvenate downtown areas and preserve historic structures are expected to sustain the popularity of adaptive-reuse projects.

Key Conversion Criteria and Challenges

Although the potential benefits are compelling, successful office-to-residential conversions face significant hurdles. One critical challenge is the physical viability of conversion. Modern office buildings, characterized by large glass-and-steel structures, often have floorplans unsuitable for conventional apartments. Residential buildings include—and often require—features such as exterior-opening windows and in-unit bathrooms and kitchens, requiring changes in floor-to-floor height, window systems, heating and cooling units, sewers, and elevator access. As a result, smaller, older properties with suitable floorplans often are targeted for conversion.

Converting commercial real estate to housing also has unique financial obstacles. Office vacancies aren’t uniformly distributed across building age, size, quality or geography, and vacancy statistics reflect unoccupied square footage, despite the buildings housing many tenants, each with their own lease terms. Commercial-to-residential conversions also face the same zoning constraints that have led to longstanding housing shortages, including density restrictions, parking regulations and strict use prescriptions.

Despite the complexities, recent work detailed in the aforementioned National Bureau of Economic Research report found that about 15 percent of commercial office buildings in the 105 largest U.S. cities are suitable for residential conversion. Developers say conversions can be completed more quickly than new construction at costs up to 20 percent cheaper than demolish-and-rebuild projects, as explained in the March 2022 NAIOP Research Foundation report “New Uses for Office Buildings: Life Science, Medical and Multifamily Conversions” (bit.ly/3Hgv5KX). Some cities—including Boston, New York and San Francisco—are encouraging office-to-residential conversions by supporting financial incentives, changing zoning policies and finding ways to expedite plan reviews.

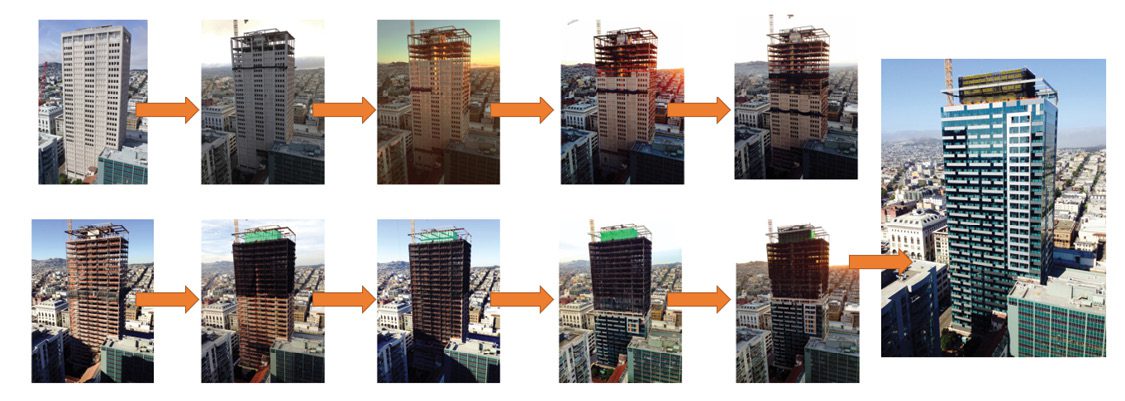

Updating San Francisco’s 100 Van Ness building in San Francisco in 2015 entailed replacing its precast-concrete panel exterior with a modern glass façade.

To avoid unforeseen challenges and added expenses in office-to-residential conversion projects, structural engineering is a crucial initial step, necessitating a thorough investigation because of each building’s uniqueness. To help building owners and designers assess such projects, Scott Campagna, vice president of housing and a senior principal for IMEG, an engineering design company headquartered in Rock Island, Ill., recently wrote the guide “Office to Residential Conversion: Key Engineering Concepts to Make Your Project Successful” (bit.ly/3Hdd3JF). In it, he explains how collaboration with structural engineers during planning is vital for aligning unit layouts with the existing structure, avoiding complexities during construction. Integrating natural light into residential units, whether through central atriums or exterior balconies, involves strategic structural modifications, with options such as fiber-reinforced polymer composites for additional strength.

Coordination with mechanical, electrical and plumbing systems is essential, with a focus on adapting existing systems to residential needs. The conversion process may also impact heating, ventilation and air-conditioning systems, allowing for the integration of desirable rooftop amenities. Changes in occupancy trigger upgrades in nonstructural components, and seismic considerations vary across jurisdictions, with some requiring retrofitting for office-to-residential conversions. Embracing such engineering considerations allows developers to successfully navigate the challenges of office-to-residential conversions, contributing to urban revitalization and meeting housing needs.

![]()

![]()

![]()

Before, during and after photos show how Philadelphia’s Brown Brothers Harriman Co. building (circa 1990) was transformed into the Beacon in 2017, with 98 luxury apartments.

Prime Examples

As shown in the accompanying photos and highlighted in the following project profiles, office-to-residential conversion isn’t a new concept. IMEG has a long history of unlocking the potential of such conversions, creating appealing and functional living spaces while contributing to urban revitalization and addressing housing needs.

2040 Market, Philadelphia. In 2013, IMEG finished renovating 2040 Market, the five-story concrete former headquarters for the American Automobile Association in Philadelphia, into a mixed-use residential building that features 282 units of one- and two-bedroom apartments with ground-level retail and an underground parking garage. Using a system incorporating a load-bearing cold-formed-steel wall panel along with a composite-joist floor system, a 120,000-square-foot vertical overbuild was designed that added eight residential floors to the existing building. The project also included a 68,000-square-foot horizontal expansion.

100 Van Ness, San Francisco. In 2015, IMEG converted the 100 Van Ness building in San Francisco, the largest office-to-residential conversion in the city to date. Updating the building’s exterior was crucial for market attractiveness. As shown in the accompanying photos, the firm replaced a precast-concrete wall system with a modern glass curtain wall. The project transformed the outdated 1974 office building into a 510,000-square-foot modern apartment building. The 29-story building includes 418 units with indoor and outdoor amenities, including a dramatic roof deck that provides residents with 360-degree views of the Bay Area, garden space, grass lawn, lounges, fire pit and a grilling area. The building earned a GreenPoint certification due to its adaptive reuse of the existing structure and high-performance curtain wall, and also achieved LEED Silver certification.

The Beacon, Philadelphia. In 2017, IMEG completed the Beacon, a six-story overbuild of the Brown Brothers Harriman Co. building (circa 1900) as well as an adjacent 14-story addition for conversion from office to residential. The completed project included 98 apartments and tenant amenities such as a fitness center, roof deck and game room. The IMEG team faced a key challenge in the overbuild design, focusing on meeting lateral-load code requirements. To address this, the team incorporated a horizontal expansion into an adjacent 28-foot parcel, providing ample capacity to support lateral loads for the new addition and the existing structure.

Upcoming Projects. In 2025, IMEG plans to finish two additional adaptive-reuse projects:

• Two Ruan, a 14-story office building in Des Moines, Iowa, is being converted to 200 apartments, taking more than 200,000 square feet of vacant office space off the market.

• Victory Center, an 11-story office building in Alexandria, Va., is being converted to 400 apartments, along with townhomes and a multifamily tower on an adjacent parking lot.

Additional project profiles as well as further insights on structural, mechanical, electrical and plumbing engineering challenges and opportunities in office-to-residential conversions are available on the IMEG blog at www.imegcorp.com/insights/blog.

The Future of Office-to-Residential Conversions

Experts anticipate a long-term shift in office-space demand, giving office-to-residential conversions a crucial role in revitalizing urban spaces. Although challenges persist—including the time-consuming nature of conversion projects, physical constraints and financial obstacles—federal support and local initiatives are paving the way for a transformative wave in urban development. As cities incentivize conversions, architects and developers anticipate a boom in adaptive reuse projects, contributing not only to housing solutions but also to environmental sustainability and the revitalization of urban landscapes.

About John Hughes

John R. Hughes is a freelance writer specializing in issues related to urban planning and sustainable development. He can be reached at [email protected].