Executive Corner: Is Your Company’s Stock a Good Investment?

“The best investment I ever made!”

I can’t tell you how often I’ve heard owners in the architecture, engineering and environmental consulting industries say something to this effect when I’ve asked about the performance of their company stock. There are exceptions, of course, but this is by far the more-common refrain. Yet many firms struggle with their ownership transition plans due to a lack of demand for stock among their next generation of leaders.

Competing Capital

When a company offers stock to new shareholders, it’s competing for capital with many other investment options, such as real estate, the public stock market, government bonds, etc., and buyers often have minimal financial resources. A key to a successful ownership transition plan is ensuring that your company’s stock compares favorably to the many investment alternatives a buyer has for their limited capital.

So, is your A/E firm’s stock a good investment? To answer that, you first need to look at its return on investment (ROI). Your firm’s ROI is the sum of the dividend or distribution paid per share and the appreciation of its share price over the course of the year, divided by its starting share price.

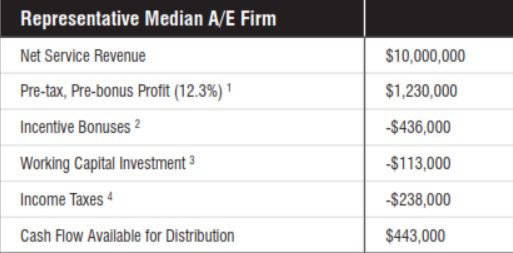

To illustrate this calculation, let’s take the example of a firm generating $10 million in net service revenue and employing approximately 70 people. The table below shows the cash flow available to the shareholders of this representative industry firm using industry-median financial performance levels as footnoted.

Based on the latest available survey data, the following table details this representative firm’s ROI.

1 Median pre-tax, pre-bonus profit from A/E Business Valuation and M&A Transactions Study

2 Staff bonuses estimated based on median bonus per employee from 2019 Deltek Clarity industry survey

3 Working capital investment based on median three-year compounded annual growth rate of 6.8% and a working capital turnover rate of 6x/year

4 Income taxes (combined federal and state) estimated at 30% of taxable income

5 Equity value based on the median multiple of pre-tax, pre-bonus profit (3.02x) from A/E Business Valuation and M&A Transactions Study

6 Equity value assumed to grow at the industry median three-year compounded annual growth rate of 6.8%

In this case, an investment in this firm would indeed be very attractive relative to alternatives. For perspective, the S&P 500 produced a return of 12.8% in 2018 and an average return during the last 20 years of slightly more than 8%.

Investment Differences

Of course, there are some substantial differences between investing in the public stock market and investing in a privately held A/E firm that must be considered. The first is liquidity or lack thereof. Unlike a publicly traded firm, your ability to sell your shares in a privately held A/E firm will likely be governed by a shareholders’ agreement. In most cases, you may only sell your shares back to the company or to other shareholders, and only upon retirement, termination of employment or other circumstances.

Stock in a privately held firm also is considered more at risk for loss of capital than that of larger, publicly traded firms. These much-larger firms tend to be more diversified and not overly dependent on particular markets, clients or individual employees.

To overcome the greater risk and lower liquidity, a privately held A/E firm’s ROI needs to be higher to attract investment, and based on the industry analysis above, on average it is. So why do firms still struggle with a lack of internal demand for company stock? In some cases, this may be because the ROI isn’t strong enough, either due to poor financial performance, overly aggressive stock pricing, or both. More frequently, however, it’s because the firm failed to effectively communicate how its stock has historically performed.

If fairly priced, the stock in your A/E firm could very well be one of your best-performing assets. And it’s one of the very few investments that you have the power to influence.

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.