Executive Corner: Five Takeaways on 2023 A/E M&A Activity

Despite an overall slump in M&A deal volume globally, the A/E industry wrapped up 2023 with yet another busy year of elevated activity. Shrugging off recession worries and higher interest rates, confident strategic and financial buyers showed no signs of slowing down their appetite for synergistic targets across a variety of disciplines. With a relentless war for talent and favorable design outlook as tailwinds, organizations are boldly seeking to transform, diversify and scale to position themselves on the competitive landscape chessboard.

As the year concluded, we expect North American transactions will be down 9 percent from 2022, but that year marked a record number of deals, so a pullback from those lofty levels was not unexpected. During the last five years, M&A has been running at a torrent pace. It has been, on average, 60 percent higher than the previous five years. In this post-pandemic period, characterized by double-digit growth rates, strong bottom lines, healthy balance sheets (“dry powder”), billions in PPP forgiveness and the enactment of multiple massive infrastructure bills, conditions have never been better for widespread consolidation.

We also should note that the A/E industry is coming to the end of the Baby Boomer ownership era. This enormous group of individuals, who changed the profession through 40 dynamic years, has paved the way for new generations. Press releases and LinkedIn posts tout retirements, tributes and transitions at an increasing rate. And while some owners have successfully sold their stakes internally, countless Boomers have chosen to exit through M&A to unlock their values and sustain their companies for the future.

Key A/E M&A takeaways include the following:

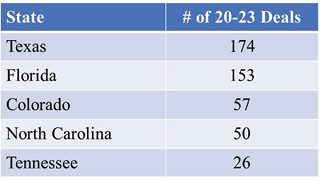

1. Consolidation has resulted in fewer A/E firms. There have been more than 1,700 transactions since the start of the decade and more than 3,200 in the last 10 years. Approximately 60 percent of sellers have been small firms with less than 25 employees. The result has been a dramatic reduction of U.S. A/E companies. To illustrate this attrition, the accompanying chart shows the number of M&A deals in five “hot” states since 2020.

While we’ve been encouraged by new business formations and entrepreneurship among Millennials, the reality is that it will take years of consistent startups to replenish the volume of firms being sold.

2. Valuations remain attractive. A “perfect storm” has emerged of eager strategic buyers and private-equity firms, in some cases a diminishing number of qualified targets, and strong seller financial performance; all of which has led to healthy valuations being paid. Smaller firms typically are selling between 4.0-6.0x EBITDA, while larger companies—or ones in attractive markets or states—can command even higher. While we’ve seen sensible valuations for solid companies and seasoned executive teams, this frothy environment also has produced overpayment situations that have left us skeptical on strategic rationale and future returns.

3. Private equity in the A/E space is here to stay. The last five years ushered in a wave of private-equity interest and involvement, recapitalizing and reshaping many of the firms up and down the ENR 500. While the pace slowed in 2023, several venerable organizations (e.g., Pape-Dawson Engineers, Gannett Fleming, Langan Engineering and Environmental Services, Populous, WSB, etc.) became new platform investments with financial sponsors. Other “family of brands” models that have amalgamated different A/E firms with outside capital remained active. The year witnessed more companies that went private equity 4-5 years ago exit their first financier for a second-stage one. These sales allow the initial sponsor to return capital to fund investors while releasing additional value for owners with rollover equity.

4. Transactions are becoming more sophisticated. The nature of putting A/E deals together is more complex and intricate than ever before. Beyond basic asset or stock purchases, suitors are coming to the table with various hybrid models (e.g., 338h(10) elections, F reorganizations, forward/reverse mergers, etc.). Sellers must be educated quickly on the nuances of understanding working capital delivery and calculations, tax ramifications on their proceeds, holdbacks and escrows, baskets and caps on indemnification obligations, rollover basis in the buyer’s stock, and purchase-price allocations. And, as always, the nature of earnouts/contingent payments can be a thorny and challenging issue.

5. Integration makes or breaks. With dizzying M&A volumes comes the need for skillful and intentional integration. Combining two design firms is a fragile exercise and takes sustained effort from both parties. While we’re seeing many deals exhibit post-closing cohesion and chemistry, there are others that have failed to properly plan, communicate and execute on blending cultures, systems and people successfully. We’re in a tight labor market where staff can freely leave and find better opportunities if they’re unhappy with their new employer. In our experience, getting ahead of potential problems in the courtship and due diligence phases as well as confronting anxious staff with candor and confidence goes a long way.

About Steve Gido

Steve Gido specializes in corporate financial advisory services, including mergers and acquisitions, business valuations, ownership transition plans, and strategic planning for engineering, architecture, environmental consulting and construction firms. He leads ROG+ Partners’ merger and acquisition practice, and has advised on a wide number of A/E/C transactions, representing buyers and sellers of all sizes and disciplines.