Executive Corner: Inside the Latest A/E Business Valuation and M&A Transaction Study

With economic growth slowing and interest rates rising, it’s not surprising that A/E firm valuation multiples have ebbed from their post-pandemic peaks. The latest valuation statistics from the recently released “A/E Business Valuation and M&A Transactions Study” (10th edition) show that for all transaction types—minority interests in privately held companies, controlling interest (M&A) transactions and public market transactions—valuation multiples have declined, albeit only slightly.

Survey Says

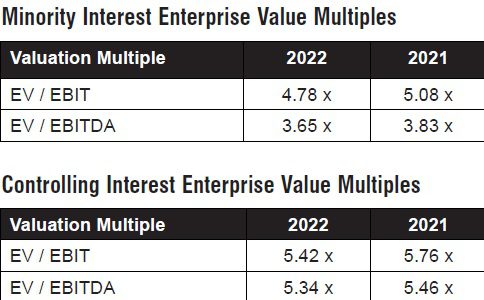

This year’s survey included 241 transactions, including internal minority interest ownership transition transactions and controlling interest merger and acquisition (M&A) transactions. The tables below illustrate the enterprise values of the surveyed firms as a multiple of earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation and amortization (EBITDA).

With internal transactions, there are several factors at work. For many firms, valuations in 2021 were buoyed by excess liquidity resulting from forgiven Paycheck Protection Program loan proceeds. For firms establishing their value through independent valuations, higher rate of return expectations and lower market pricing of publicly traded A/E firm stocks also are factors in the lower valuations.

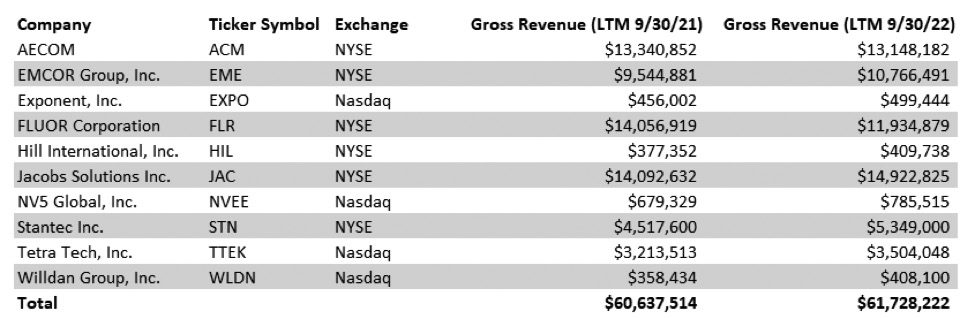

In addition to the data on privately held companies, the study tracked the growth and pricing of 10 publicly traded A/E and environmental consulting firms during the last year. As the table shows, in aggregate, the gross revenue of the 10 firms grew at a modest rate of 1.8 percent during the last year (using reported trailing 12 months’ revenue through Sept. 30).

In spite of this modest growth, or perhaps because of it, the total value of this portfolio of publicly traded firms, as measured by aggregate market capitalization, declined 4.6 percent during the same period. Interestingly, this decline in market capitalization correlates closely to the observed decline in private company valuation multiples.

About the Study

The 10th edition of the A/E Business Valuation and M&A Transaction Study is available online at www.rog-partners.com/aestudy. The study is designed to inform industry executives of current trends in the transacted values of architecture, engineering and environmental consulting firms.

This study is different from others because it’s based on actual transactions instead of reported valuations. These include transactions by and between employee-owners, employee stock ownership plan (ESOP) transactions and mergers/acquisitions. The study includes data on 10 separate valuation multiples and 23 financial performance metrics. Multiples are separately reported on a controlling interest, minority interest and ESOP ownership basis.

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.