Executive Corner: How Private Equity Is Quietly Transforming the A/E Industry

Whether in nature, design, health or business, lasting and significant changes seldom occur quickly, but often steadily through time. You open your eyes years later to a new paradigm or landscape that has unfolded, which ultimately requires recognition and adaptation. For the A/E industry, the most-dramatic shift in ownership models is coming from a new class of outside investors: private equity. Ten years ago, the notion of a sophisticated financial coterie joining forces with creative and cerebral A/E leaders certainly was a curious marriage. Today, these parties are rushing to the altar like never before.

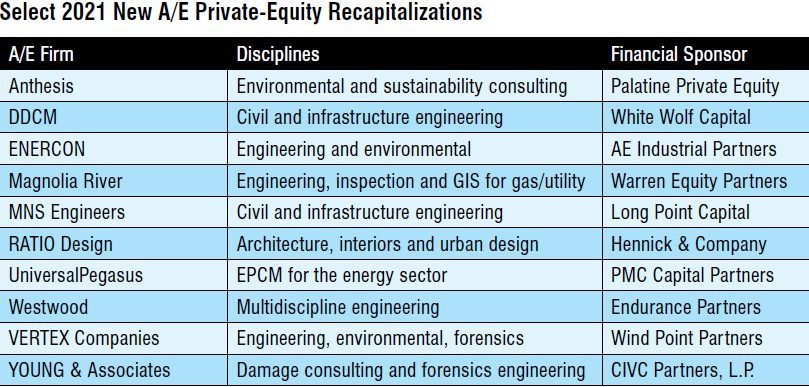

In fact, almost every A/E discipline—geotechnical, civil, surveying/geospatial, MEP, environmental, construction management, forensics and architecture—has private-equity backing. More than 80 venerable industry icons now have financial sponsors, including a growing number of the ENR 500. So what’s behind this, and how is private equity altering our industry? Let’s go through the fundamentals and rationales.

What Exactly Is Private Equity?

Private-equity investors are seasoned financial professionals with experience in evaluating and analyzing various industries and companies. The firms they oversee raise funds of capital from institutional investors and high-net-worth families and individuals, also known as limited partners. They then will invest these proceeds in mature, privately held businesses with the goal of increasing their value through time. The private-equity managers eventually will sell the business, thus (hopefully) returning the profits at a higher yield than what these limited partners could earn in alternative asset classes.

How Does a Typical Private-Equity Investment Work?

Private-equity firms have a set of criteria for the types of “platform” businesses they seek. Some may only be interested in certain industries or just invest in distressed companies. Others may prefer to buy companies in a specific geographic region. However, most of them have minimum size thresholds regarding their desired financial characteristics, usually annual revenue and EBITDA.

After the financial sponsor has engaged with a management team and there’s interest in a potential transaction, a letter of intent outlining the terms and valuation is prepared. In most cases, the private-equity firms will want to acquire a controlling stake in the target company, but some may choose to take a minority position under the right set of circumstances.

Most of these deals are funded using a combination of equity and a sizable portion of debt, which must be repaid by the target company. Thus, businesses with steady and predictable cash flow along with strong top-line prospects are sought after. Private-equity investors bring financial acumen, growth capital, and other managerial resources and ideas to help their platforms succeed. These firms will collect management fees and performance/incentive fees to cover fund-management expenses and promote future financial success.

Why Is There Serious Interest in the A/E Sector?

We live in a world today with billions of dollars available in capital circling all around the world looking for outsized returns. We also are in a period of extraordinarily low interest rates, which naturally lowers the cost of financing and can help enhance the return on investment. Historically, private equity sought deals in traditional industries such as retail, manufacturing, food and beverage, logistics, energy, etc., and others that were normally asset intensive. The idea of investing in professional-service firms, with “elevator assets” and the fickleness of company cultures and lack of tangible equipment, factories or inventories generally was avoided.

The fact that there’s now so much capital chasing so few investment opportunities has pushed previously hesitant investors into exploring the merits of professional- and business-services firms. In addition, the underlying growth prospects and industry dynamics for a range of engineering and environmental services are quite favorable. Air, water and land sustainability and stewardship—in addition to a renewed push for infrastructure repair and modernization—have broad appeal and are attractive investment themes. Well-managed firms in our space generally produce steady single-digit revenue gains, attractive EBITDA margins and dependable cash-flow characteristics that appeal to investors.

Why Are More A/E Owners Choosing This Route?

With changing demographics, the A/E industry faces unprecedented ownership-transition challenges. Many baby-boomer owners are seeking the best option to successfully exit their firm, which may include an internal sale to younger employees, implementing an Employee Stock Ownership Plan (ESOP) or selling outright to a strategic buyer. But not everyone wants to sell to a 30,000-person publicly traded firm or establish an ESOP that may not bring other growth-oriented advantages.

Leaders who have gone the private-equity route often will share they enjoy a higher degree of independence and autonomy as well as “keeping our name on the door” vs. selling to a larger strategic buyer where there’s potential risk of organizational change and culture conflicts. They’re able to “take some chips off the table” but also rollover a portion of their equity into the new, recapitalized platform. That may allow for a “second bite” when the private-equity firm decides to sell (to another financial sponsor or large strategic buyer), and the minority owners cash out again in a follow-up transaction. Valuations often can be higher when selling to a private-equity firm.

What Are the Ramifications to Our Industry?

Financial sponsors often can bring a more-pronounced mindset of aggressive growth compared to other conservative employee-owned design or consulting competitors. In fact, for the last decade, private-equity-backed platforms have been some of the most-prodigious buyers of smaller A/E firms (those with less than $10 million in revenue). Given the “buy vs. build” paradigm and how challenging it can be to grow professional-service practices, financial investors often are seeking to expand through multiple, synergistic acquisitions.

These platforms also actively lure other industry professionals from competitors to their leadership teams and boards. Using the prospect of direct equity, stock options, signing bonuses and future liquidity events, seasoned C-level talent and technical leaders are recruited to help transform and reorganize companies to better maximize performance and penetrate new markets.

Is that to say all these transactions work seamlessly or will achieve their desired outcomes? Not necessarily. To be sure, not all private-equity firms are alike. And like any merger, sellers need to understand the goals and motivations of their suitor as well as the short- and long-term tradeoffs of the partnership. How will the governance-arrangement work? With profits now allocated to paying off debt, what does that mean for reinvestment and incentive compensation? How will staff and clients react to the new model? What does the future hold?

About Steve Gido

Steve Gido specializes in corporate financial advisory services, including mergers and acquisitions, business valuations, ownership transition plans, and strategic planning for engineering, architecture, environmental consulting and construction firms. He leads ROG+ Partners’ merger and acquisition practice, and has advised on a wide number of A/E/C transactions, representing buyers and sellers of all sizes and disciplines.