Executive Corner: The Pandemic’s Impact on A/E Firm Ownership

A psychological shift seems to be taking place as we begin to migrate back to “normal.” More Americans are shifting their views on retirement, with many considering retiring earlier than initially planned. In a recent phone call, an A/E firm owner (aged 62) told me they had always planned to work full-time until they were 70, then scale back their hours for a few years after that. But since the pandemic, their goals have changed. They now are considering selling their firm and only working another three years.

This owner’s shift in retirement goals is not an isolated incident. Since the beginning of 2021, more firms have been inquiring about ownership transition planning or selling their firms to shorten their time to retirement. We can theorize as to why this is happening.

Timing Is Everything

The “life is short” mentality is undoubtedly playing a role. The pandemic encouraged all of us to take inventory of what’s truly important. At the outset of the pandemic, lives were lost, income suffered and wealth shrunk on the order of 25 percent to 30 percent as stock markets contracted at precipitous rates. Exacerbating this mentality are the fresh memories of the Great Recession that occurred only a dozen years ago. Experiencing two significant wealth-evaporating events in a short period of time has taken its toll on the psyche of A/E firm owners. It took nearly six years from the valuation peak before the Great Recession to recover all that was lost, and many A/E firms disappeared altogether.

Fast forward to the present, and we find that most firms adapted seamlessly to the work-from-home environment (with many now back in the office), federal relief helped firms sustain their operations, individual incomes rebounded quickly, and virus-related mortality levels declined thanks to vaccine development and deployment. With stock-market wealth recovered during the last year and increasing real-estate values, many A/E firm owners now find themselves at the peak of their net worth. This has made early retirement more feasible for many.

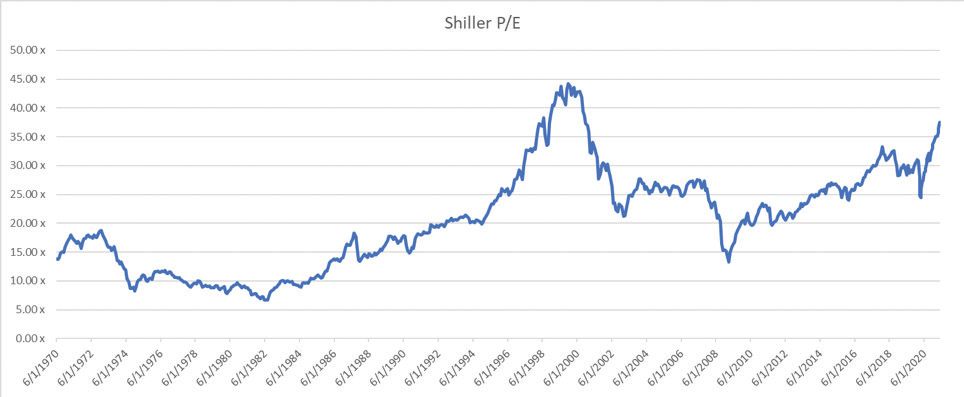

Furthermore, for owners of A/E firms, their company’s valuations are nearing historic highs. We can see evidence of this in the public markets. The Shiller S&P 500 price-to-earnings (P/E) ratios are nearing levels not seen since the late 1990s. The Shiller S&P 500 P/E ratios take into consideration the impact of inflation on valuation multiples. As the accompanying chart indicates, the current Shiller P/E ratios are closer to their all-time highs than to historical norms. They are trading at 37.5 times earnings, which is more than two times higher than the P/E average from January 1900 to May 2021 of 17.3 times.

Earnings are expected to grow significantly in 2021; however, valuations are unlikely to continue their current growth rates of 14 percent per annum since 2010 and 17 percent per annum since 2016, as these levels are simply unsustainable. Valuation growth likely will flatten by the end of 2021, and P/E multiples should begin to normalize during the next 12 to 24 months.

Selling High

Other factors such as inflation risks and the prospect of higher taxes (income and capital gains) also could put downward pressure on stock values. We can look to history as a guide as to how such factors impact stock valuations. As the Shiller P/E chart shows, in the late 1970s and early 1980s, the United States was experiencing high inflation (the prime lending rate hit 21.5 percent in December 1979) and high taxes, and P/E ratios were in the single digits.

In terms of ownership transition planning, the prospect of higher corporate income taxes is likely to cause firms to consider alternative ownership structures that include an employee stock ownership plan (ESOP) or an equity-based deferred compensation plan, which improve the liquidity of shares and lower corporate tax and pass-through tax obligations. Furthermore, the potential for a substantial increase in capital-gains tax rates puts pressure on owners considering a firm sale to consummate a transaction before rates increase.

If your time for retirement is fast approaching, and you have the means to fund your retirement, now may be the time to take action. Whether you intend to sell your shares to your employees or sell your company to a strategic buyer, waiting too long could result in leaving substantial money on the table.

About Michael O'Brien

Michael S. O’Brien is a principal in the Washington, D.C., office of Rusk O’Brien Gido + Partners, specializing in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning; email: [email protected].