February 2019 TRENDS

New Report Identifies Corrosion as Major Threat to Public Health

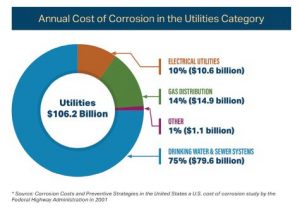

NACE International, a nonprofit association and leading resource for corrosion expertise and education, released its “Spotlight on Corrosion Report: The Critical Need for Corrosion Management in the Water Treatment Sector.” Based on input from more than 1,300 corrosion professionals, the report identifies aging water infrastructure as a pressing, costly, yet resolvable threat to public health, and recommends the adoption of Corrosion Management Systems as an immediate solution for water utilities and municipal systems.

“Like much of our nation’s infrastructure, our drinking water pipelines and systems are nearing the end of their useful life,” said Bob Chalker, NACE International CEO. “Ignoring this critical infrastructure until repairs are needed is far costlier, both economically and socially, than preventing corrosion from occurring in the first place. We all need water; we owe it to our communities to get it right from the start.”

According to a Federal Highway Administration study, the direct cost of corrosion in U.S. drinking water and sewer systems is $80 billion annually, which includes the costs of replacing aging infrastructure and lost water from pipeline leaks, but it does not include the immeasurable cost of widespread health crises that corrosion can create, such as what happened in Flint, Mich.

The full report is available at www.nace.org/spotlight.

According to the U.S. Energy Information Administration (EIA), some 24 gigawatts (GWs) of electric generation capacity will be added to the nation’s electrical grid in 2019, with 8 GWs of capacity set to retire.

Of the new 24 GWs, 46 percent will be from wind, and 18 percent will be generated by solar for a combined total of 64 percent of the new electric generation capacity coming from renewable sources.

In addition to the renewable projects set to come online, 34 percent of 2019’s new capacity will come from natural gas power plants.

According to the EIA, more than half of the 10.9 GWs of new electric capacity to come online in 2019 will come from the Midwest in Texas, Iowa and Illinois, while more than half of the 4.3 GWs of new capacity due to solar will come from California, Texas and North Carolina.

Of the 8 GWs of capacity set to retire in 2019, 4.5 GWs will come from retired coal-fired plants. In 2018, 13.7 GWs of coal-fired electric capacity was retired, the second-highest total ever.

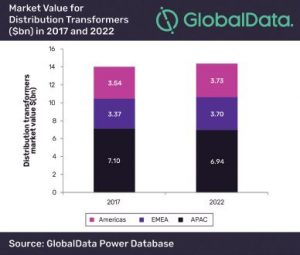

APAC to Drive Global Distribution Transformers Market

Asia-Pacific (APAC) will continue to lead the distribution transformers market of the global power sector with a share of 48 percent and reach $6.94 billion in 2022, according to GlobalData, a data and analytics company.

The company’s latest report, “Distribution Transformers Market, Update 2018,” reveals that the global market value is likely to reach $14.32 billion in 2022, growing at a modest CAGR of 1.6 percent between 2018 and 2022.

“Systemic transformation of the global power sector is contributing to the requirement for power technologies, which support low-carbon power generation,” said Nirushan Rajasekaram, Power Analyst at GlobalData. “Markets in the U.S. and Europe are primarily replacement markets, with initiatives undertaken to enhance the adaptability of the grid to changing market conditions. Other countries in APAC and Middle East are constructing new grid networks to support and sustain the growing power generation segment and demand requirement.”

Political and business leaders from around the world outlined the far-reaching geopolitical implications of an energy transformation driven by the rapid growth of renewable energy. In a new report launched at the Assembly of the International Renewable Energy Agency (IRENA), the Global Commission on the Geopolitics of Energy Transformation says the geopolitical and socio-economic consequences of a new energy age may be as profound as those which accompanied the shift from biomass to fossil fuels two centuries ago. These include changes in the relative position of states, the emergence of new energy leaders, more diverse energy actors, changed trade relationships and the emergence of new alliances.

The commission’s report, “A New World,” suggests that the transformation will change energy statecraft as we know it. Unlike fossil fuels, renewable energy sources are available in one form or another in most geographic locations. This abundance will strengthen energy security and promote greater energy independence for most states. At the same time, as countries develop renewables and increasingly integrate their electricity grids with neighbouring countries, new interdependencies and trade patterns will emerge. The analysis finds that conflict related to oil and gas reserves may decline, as will the strategic importance of some maritime chokepoints.

The energy transformation also will create new energy leaders, the commission points out, with large investments in renewable energy technologies strengthening the influence of some countries. China, for example, has enhanced its geopolitical standing by taking the lead in the clean energy race to become the world’s largest producer, exporter and installer of solar panels, wind turbines, batteries and electric vehicles. Fossil-fuel exporters may see a decline in their global reach and influence unless they adapt their economies for the new energy age.

“This report represents the first comprehensive analysis of the geopolitical consequences of the energy transition driven by renewables, and a key milestone in improving our understanding of this issue,” said Commission Chair Olafur Grimsson, the former President of Iceland. “The renewables revolution enhances the global leadership of China, reduces the influence of fossil fuel exporters and brings energy independence to countries around the world. A fascinating geopolitical future is in store for countries in Asia, Africa, Europe and the Americas. The transformation of energy brings big power shifts.”

The full report can be found at geopoliticsofrenewables.org/report.

FMI Releases 2019 Overview, Featuring U.S. and Canada Construction Outlooks

FMI Corporation, a provider of management consulting and investment banking services to engineering and construction, infrastructure and the built environment, released its “2019 FMI Overview,” featuring FMI’s latest forecast: the 2019 U.S. and Canada Construction Outlook. The publication offers comprehensive construction forecasts for a broad range of market segments and geographies in the U.S. and Canada, and provides valuable insights from FMI executives on how to navigate the next 12 months.

Key highlights of the report include:

• 2018 marked another strong year for the North American built environment, with total U.S. engineering and construction (E&C) spending growth expected to finish at 5 percent, the same as in 2017.

• Spending growth in 2018 was predominantly led by transportation and select private nonresidential segments.

• Looking ahead to 2019, FMI forecasts a 3 percent increase in spending levels over 2018.

• Primary growth segments in 2019 are expected to include office, educational, public safety, transportation, conservation and development, and manufacturing—all with forecast growth rates of 5 percent or more.

• Most other segments will likely grow by roughly the rate of inflation and therefore be considered stable.

• Multifamily, lodging and religious are three segments expected to experience decline through 2019.

• In Canada, total construction spending put in place is anticipated to be just shy of $260 billion for 2018. This comes to a modest 3 percent increase over 2017 or about $9 billion in additional investment. Looking ahead to 2019, FMI forecasts another year of modest growth, with total construction spending topping $275 billion.

FMI’s key advice for 2019 is: “Keep calm, stay focused and get ahead of the next downturn.”

According to Chris Daum, FMI’s CEO, “Now is the time to get proactive with conversations and planning around lessons learned from the last downturn and ‘recession-proof’ your company. While the last recession was historic in scale and duration, the next downturn will likely look very different. Still, through good preparation, companies can take the lessons they (or their predecessors) learned from the last recession and use them to avoid repeating any costly mistakes.”

To access the 2019 FMI Overview, featuring FMI’s latest forecast, the 2019 U.S. & Canada Construction Outlooks, visit: https://www.fminet.com/construction-outlook/.

To access FMI’s New Forecast: The 2019 Canadian Construction Outlook, visit: https://www.fminet.com/canadian-outlook/.

TOP Stories

The following are the top stories from the last few months (in terms of traffic) on the Informed Infrastructure website. This also reflects key coverage areas that are regularly refreshed online and via our weekly e-newsletter. Simply search key words on Informed Infrastructure online to find the full story.

• Video: MIT Mass Timber Design — Longhouse

• Metal Sales Manufacturing Corporation Partners with Rabbit Hole Distillery for World-Class Design

• Vulcraft Announces Winners of 2018 NuHeights Design Awards

• Startup ‘Module’ Constructs First Expandable, Energy Efficient Home Using Passive House Principles

Transportation

• Thornton Tomasetti Volunteers Help Build Bridge in Panama

• PennDOT Data Shows Pennsylvania Roundabouts Reducing Crashes, Injuries and Fatalities

• Acrow’s Bridge Structures Support Renovation of Historic Covered Bridge in Québec

Water

• Bionetix International Introduces Natural and Economical Approach to Enhancing Water Clarity

• San Francisco Public Utilities Commission Receives $699 Million EPA Loan for Wastewater Upgrades

• Brown and Caldwell Strengthens Smart Utility Offering with BC Blue

Tools and Technology

• The Energy Co-op Launches New Clean Energy Blog

• Bentley Acquires Agency9 to Realize Digital Twins for Every City

• ProNovos Launches Operations-Focused Platform for Construction Biz

• ULIS Launches ThermEye Building, a New Product Line Dedicated to Smart Building Applications