GlobalData reveals top 10 financial and legal advisers in power sector for H1 2022

GlobalData has announced the latest Financial and Legal Adviser League Tables in the power sector, which rank the advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in H1 2022. See the rankings and findings below.

Financial Advisers

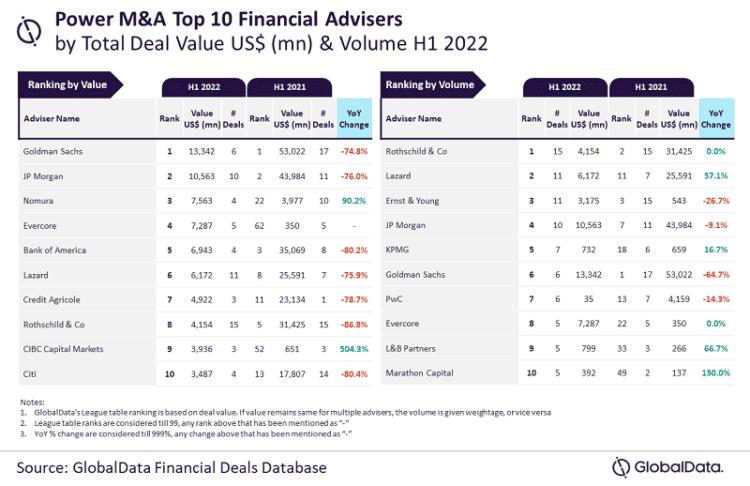

Goldman Sachs and Rothschild & Co top M&A financial advisers by value and volume in power sector for H1 2022, finds GlobalData

Goldman Sachs and Rothschild & Co were the top mergers and acquisitions (M&A) financial advisers in the power sector for H1 2022 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData.

Based on its Financial Deals Database, the leading data and analytics company has revealed that Goldman Sachs achieved its leading position by value by advising on $13.3 billion worth of deals. Meanwhile, Rothschild & Co led by volume by advising on a total of 15 deals.

According to GlobalData’s report, ‘Global and Power M&A Report Financial Adviser League Tables H1 2022’, a total of 671 M&A deals worth $163.9 billion were announced in the power sector during H1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Rothschild & Co led by volume but lagged in terms of value and settled for the eighth position by this metric. Meanwhile, Goldman Sachs advised on fewer but big-ticket deals, which helped it to secure the top position by value. Four of the six deals advised by Goldman Sachs were billion-dollar deals (≥ $1 billion) while Rothschild & Co advised on two such deals.”

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan occupied the second position by value, by advising on $10.6 billion worth of deals, followed by Nomura with $7.6 billion, Evercore with $7.3 billion and Bank of America with $6.9 billion.

Meanwhile, Lazard occupied the second position in terms of volume with 11 deals, followed by Ernst & Young with 11 deals, JP Morgan with 10 deals and KPMG with seven deals.

Legal Advisers

Latham & Watkins and Kirkland & Ellis top M&A legal advisers by value and volume in power sector for H1 2022, finds GlobalData

Latham & Watkins and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in the power sector for H1 2022 by value and volume, respectively, according to the latest Legal Advisers League Table by GlobalData.

Based on its Financial Deals Database, the leading data and analytics company has revealed that Latham & Watkins achieved its leading position by value by advising on $16.7 billion worth of deals. Meanwhile, Kirkland & Ellis led by volume by advising on a total of 21 deals.

According to GlobalData’s report, ‘Global and Power M&A Report Legal Adviser League Tables H1 2022’, a total of 671 M&A deals worth $163.9 billion were announced in the power sector during H1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Both Latham & Watkins and Kirkland & Ellis were the clear winners by value and volume, respectively. While Latham & Watkins was the only firm to surpass the $15 billion mark in total deal value, Kirkland & Ellis was also the only firm to advise on more than 20 deals during H1 2022. Interestingly, Latham & Watkins and Kirkland & Ellis also managed to register robust growth in value and volume in H1 2022 compared to H1 2021, respectively.”

An analysis of GlobalData’s Financial Deals Database reveals that Allen & Overy occupied the second position by value, by advising on $12.5 billion worth of deals, followed by Clifford Chance with $9.8 billion, Herbert Smith Freehills with $9 billion, and King & Wood Mallesons with $8 billion.

Meanwhile, CMS occupied the second position in terms of volume with 17 deals, followed by Latham & Watkins with 13 deals, White & Case with 13 deals, and Watson Farley & Williams with 13 deals.

For more information

To gain access to our latest press releases: GlobalData Media Centre

Analysts available for comment. Please contact the GlobalData Press Office:

EMEA & Americas: +44 207 936 6400

Asia-Pacific: +91 40 6616 6809

Email: [email protected]

For expert analysis on developments in your industry, please connect with us on:

GlobalData | LinkedIn | Twitter

Notes to Editors

- Quotes are provided by Aurojyoti Bose, Lead Analyst at GlobalData

- The information is based on GlobalData’s Financial Deals Database

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, we have considered M&A including asset transactions, venture capital and private equity deals where advisors were involved.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.