Executive Corner: A Peek Inside the Latest Data-Valuation Trends

The latest valuation statistics from the recently released “A/E Business Valuation and M&A Transactions Study” reveals some interesting trends, including significantly higher valuation multiples for larger firms and higher equity values across the board due to improved profitability and stronger balance sheets.

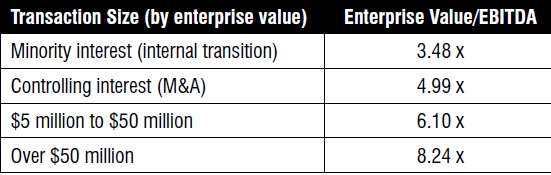

Table 1 illustrates overall enterprise values as a multiple of earnings before interest, taxes, depreciation and amortization (EBITDA) in 2021. The “minority interest valuation multiples” reflect enterprise values (i.e., the value of a company on a debt-free, cash-free basis) of firms that have traded minority (non-controlling) ownership stakes, typically as part of an internal ownership transition or non-controlling ESOP transaction. The “controlling interest EBITDA multiples” reflect the enterprise values of firms that have been acquired by—or merged with—another firm.

Table 1. Enterprise Value/EBITDA

When survey data are analyzed as a whole, the overall enterprise values were relatively unchanged from the prior year. However, the aggregated data masks some trends within specific sample segments. For example, 2021 not only brought a robust recovery following the initial impact of the COVID-19 pandemic, but it also brought a sharp increase in M&A activity, with notable activity among large private-equity players. As illustrated in Table 2, the demand for larger firms among private equity and larger, well-funded strategic buyers can be seen in the markedly higher multiples paid for larger firms.

Valuation multiples, of course, are just one side of the valuation equation. Growth in earnings in 2021, driven by economic recovery and federal spending, has also driven value growth. The surveyed firms experienced net service revenue growth of 6.3 percent on average and increased profit margins. The average pre-distribution EBITDA margin increased from 16.1 percent to 16.5 percent in 2021, and the average pre-tax, pre-bonus profit margin increased from 15.0 percent to 15.7 percent. So even with overall average valuation multiples holding steady, the typical firm would have experienced a 7.5 percent increase in its enterprise value due to revenue and earnings growth alone.

Table 2. Enterprise Value/EBITDA by Size

In Good CARES

Finally, it’s important to note that these enterprise values don’t reflect the impact of CARES Act relief that many small and mid-size firms received during the pandemic. Many A/E firms qualified for and received Paycheck Protection Program (PPP) loans in 2020 and 2021, and most qualified for and received complete forgiveness of these loans. For firms that recovered quickly from the initial impacts of the COVID-19 pandemic, the forgiven PPP loans have left them with unexpectedly strong balance sheets and unusually high levels of liquidity. For the average firm, the impact of PPP loan forgiveness on its equity value, which reflects cash and debt levels, was greater than the increase from earnings growth.

While we generally think of stock price appreciation as a positive thing, such spikes in equity value can create challenges for firms transitioning ownership internally. Stock-redemption liabilities become more costly, and the financial hurdles for those buying in become higher. These challenges aside, increased liquidity, strengthened balance sheets and higher stock prices also present opportunities for investment in strategic initiatives, organic growth and the ability to fund acquisitions. We expect these factors to drive continued M&A activity in 2022 and beyond.

To order the complete study, visit www.ROG-Partners.com/AEStudy.

More analysis of the results of the 2021 survey will be offered Nov. 2-4, 2022, at the Growth & Ownership Strategies Conference in Naples, Fla.

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.