Executive Corner: Newly Released A/E Business Valuation and M&A Transactions Study Shows Peak Performance

The latest edition of Rusk O’Brien Gido + Partners’ “A/E Business Valuation and M&A Transactions Study” was released on Jan. 12, 2021, showing that industry firms reached peak financial performance levels and valuations multiples immediately before the advent of the COVID-19 pandemic.

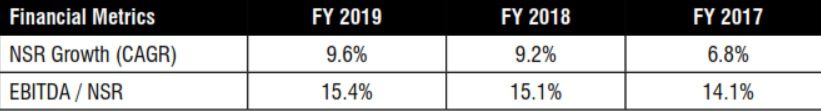

Revenue growth, as measured by three-year compounded average growth of net service revenue from 2017 through 2019, hit a high of 9.6 percent; and earnings before interest, taxes, depreciation and amortization expense (EBITDA) margins hit a high of 15.4 percent of net service revenue.

Most of the data on privately held firms was collected for fiscal years ended Dec. 31, 2019, with a smaller number of mid-year 2020 fiscal years, so the private firm statistics are largely reflective of pre-pandemic conditions. Anecdotally, senior managers at participating firms report starting the calendar year 2020 with optimistic outlooks for the year and backlog levels at or near all-time highs.

As the reality of the pandemic settled over the industry, most of these firms were able to adjust quickly to remote operations, and many actually saw improvement in utilization levels, decreases in overhead costs (mostly due to reduced travel costs, and meals and entertainment expenses) and enhanced liquidity thanks to Payroll Protection Program loans that allowed firms to maintain staff through the worst of the pandemic without depleting their balance sheets.

The most commonly cited negative trend has been a decline in contract backlog and concern over the limited opportunities to network and conduct typical business-development activities (due to COVID precautions) to replace that backlog. Similarly, although individual productivity may not have suffered, team collaboration is more difficult, and there are fewer opportunities to train and mentor junior staff. These and other factors could impair growth and financial performance in 2021 and beyond. However, the stock performance of the publicly traded firms offers some encouraging insight into the near-term outlook.

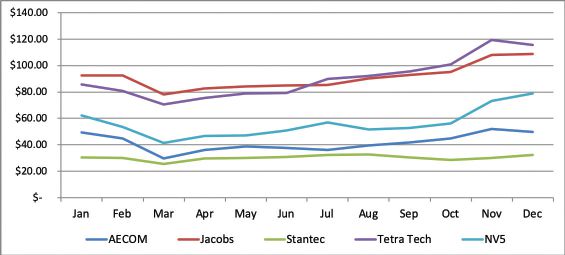

Select Publicly Traded A/E Firm Historical Share Prices – 2020

Making the Adjustments

Although public markets experienced tremendous volatility in March 2020, during the course of the year as businesses adjusted—and with the rollout of the CARES Act—markets began to settle, and stock prices began to rebound. By 2020 year-end, most publicly traded A/E firms were trading at prices well above their pre-pandemic highs, indicating improved investor confidence and outlook for the industry as a whole. The following chart illustrates the stock performance of five of the industry’s publicly traded firms: AECOM, Jacobs Engineering Group, Stantec, Tetra Tech and NV5 Global.

In terms of valuation metrics, the enterprise values of the 10 public firms tracked in the “A/E Business Valuation and M&A Transactions Study” measured as a multiple of EBIT and EBITDA during the last 12 months ended Dec. 31, 2020, were up relative to the previous three fiscal-year ends (note that many of the public firms have fiscal years ending on Sept. 30).

As we collect more data on calendar-year 2020 and Q1 2021 performance, I believe we will see further evidence of the resilience of the A/E sector to the sorts of business interruption caused by the COVID-19 pandemic. Technologies already adopted by most firms have allowed professionals in the industry to work seamlessly from remote locations, collaborate with project teams (albeit not as efficiently) and conduct meetings via video conference. Yet to be seen is how many of the adaptations made in response to the pandemic will be permanent, and if the industry will benefit in the long-term from increased productivity, lower overhead costs and other efficiencies realized during the last 12 months.

To order a copy of the “A/E Business Valuation and M&A Transaction Study,” visit www.rog-partners.com/aestudy.

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.