Executive Corner: You Just Revalued Your Share Price as of the Year-End, Then This Happened …

So 2019 was your firm’s best year EVER, and with the stock market soaring and the economic outlook for 2020 looking strong, your share price also hit an all-time high. And then this happened: A viral pandemic sweeps across the globe, states begin shutting down schools and non-essential businesses in response, the stock market drops by one-third, and oil prices plummet. Your share price was valued at $100 at year-end, but is that what it’s realistically worth now?

MICHAEL O’BRIEN, ASA, CM&AA

An Added Dilemma

As executives in the A/E industry grapple with how to keep employees safe and healthy, facilitate telecommuting, and plan for the many ways this pandemic might impact their businesses, add this new dilemma to the list.

When estimating a private company’s value, convention dictates that we, as appraisers, consider only information that was known or knowable as of the established date of the valuation, which for most firms valuing their shares annually is the calendar year-end. Even firms utilizing a valuation formula to establish their share price usually apply that formula to the latest calendar year-end financials.

But we now are living in a world that is VERY different from the year-end, and the full economic ramifications of the COVID-19 pandemic have yet to be realized. If your firm is facing significant stock redemptions this year or planning to sell shares to new shareholders, your year-end share price may no longer be appropriate for transactions occurring later in 2020.

Interim Valuations

The pandemic’s impact on stock valuation has become a particularly hot topic among firms that sponsor employee stock ownership plans (ESOPs), which are statutorily required to have their shares appraised as of the plan’s year-end for administrative purposes. That appraised value typically would dictate the share price for transactions occurring over the course of the year, including the allocation of released shares to plan participants, distributions and diversification elections. The year-end appraisal can’t take into account subsequent events such as COVID-19; that much is clear. However, some plans may allow the administrator to utilize an “interim valuation” developed as of a later date if circumstances warrant.

Assuming a plan allows for interim stock valuation, or is subsequently amended to allow it, the administrator and trustee must carefully consider whether or not to invoke this clause. There should be compelling reasons, such as cancelled or suspended contracts, major layoffs, a significant decline in cash flow or solvency concerns. Merely suspecting that your firm’s value has been impaired since the year-end appraisal may not be sufficient.

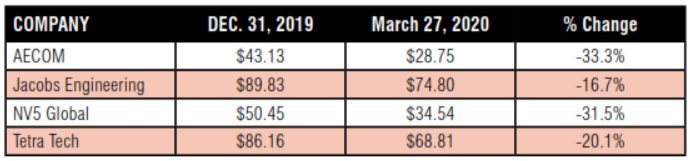

If you elect to conduct an interim valuation, the next question would be what the new valuation date should be. As of this writing (late March 2020), there’s still a lot of uncertainty as to what the future holds. The stock market continues to be wildly volatile, with 1,000 point and greater swings in the Dow upward and downward occurring almost daily. Between the calendar year-end and March 27, 2020, for example, share prices of some publicly traded A/E and environmental consulting firms had fallen by as much as a third, and it’s difficult to know when and how these guideline company values will settle.

More importantly, the business outlook for firms in the A/E industry has become quite murky. Although many firms report that their projects continue to move forward, others are beginning to report disruption due to the inability to access job sites, the interruption of supply chains for the construction industry, and general uncertainty over how the shutdown of large swaths of the economy, for however long it may continue, will impact future business.

Company forecasts and budgets for 2020 and beyond prepared in December or January are almost certainly “out the window,” but it’s too soon to know the extent they should be revised. Because of the current uncertainty, ESOP firms electing to conduct interim valuations may be wise to select a date in May or June, when (hopefully) they will have a better understanding of how revenue and earnings are tracking, and markets have settled. These firms also should consult their plan documents to determine whether they can delay the processing of distributions and diversification elections to allow time to conduct the interim valuation.

ESOP and non-ESOP firms alike should be thinking about the overall financial viability of their firms and protecting the collective interests of their shareholders in the midst of this market volatility and economic uncertainty. This may require revisiting your year-end stock valuation, but be sure to carefully review your governing documents and seek legal counsel as you make these decisions.

For more information on this subject, the following are links to resources provided by the National Center for Employee Ownership and The ESOP Association:

• esopassociation.org/covid-19-response-action-center

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.