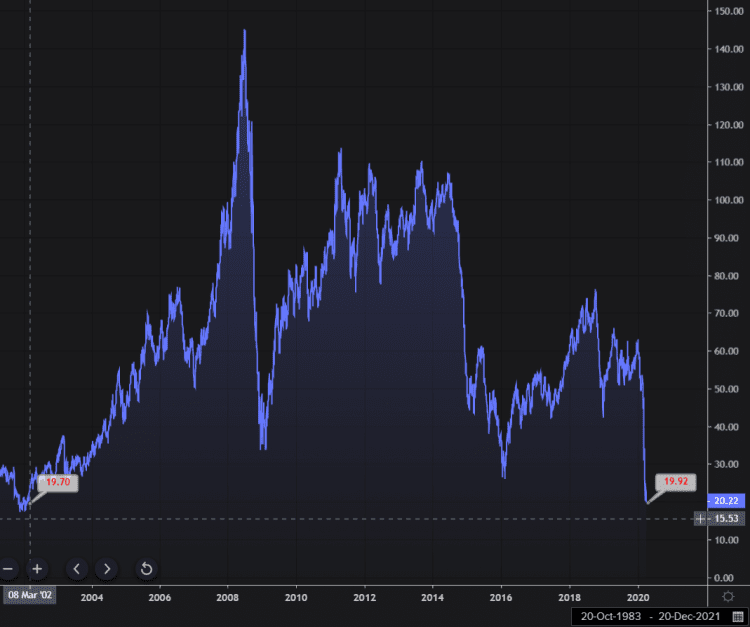

Crude Oil Plummets to 18-Year Low

Source: Refinitiv Eikon

Desperate Times, Desperate Measures

Today US WTI Crude oil prices dropped below $20 and have seen the lowest price since 2002. It’s impossible to predict where the prices will go from here, but as demand continues to weaken and the clash between Saudi Arabia and Russia continue, lower seems likely.

With the US and China struggling with COVID-19 and the repercussions on the Supply Chain, the world’s two biggest oil consumers are not looking at a recovery anytime soon. Although China (13.5mm b/d) has claimed it has seen the peak of the virus, the lack of demand from the US (20.8mm b/d) will play a major part in who needs oil and refined products.

To note, the US demand for oil and products in 2019 had seen its highest level since 2008. This will certainly move much lower as the US consumer will find many challenges ahead. If the recent numbers from Jobless Claims last week (3.283mm) are an indication, demand for gasoline is sure to drop as quickly as the Claims rose. With major cities under a shut down in quarantine and long distance travel discouraged, auto travel will suffer tremendously.

All transportation demand will come under severe pressure. We can measure the loss of driving demand based on employment, but all vacation travel will see demand declines also. Jet fuel continues to fall further in price and there’s much talk about blending these stocks into on road diesel fuel. The diesel market may be the strongest market at this time, but it’s longevity may be limited. Moving of essential goods will stay firm, but as the US sees more people unemployed, the demand for non-essential goods will then take a toll on road transportation.

Overshadowing the demand side of the current marketplace is the disagreement between Saudi Arabi and Russia. These two countries refuse to give ground around output cuts. This has created an overwhelming amount of supply of crude oil in the global market. Shipping rates are climbing and crude tankers are being booked for floating storage at a record pace, boosting spot rates to $160,000/day. There is no relief in sight as Secretary of State Pompeo has had talks with the Saudis, but there has been no action in pursuing a resolution.

In the US, many crude oil producers are hitting similar barriers as produced oil has found the lack of demand leaves the ultimate destination as storage. US oil storage has risen to a premium over the cost of crude oil and the result is a negative price. Buyers want sellers to account for the high cost of storage. Although many non-conventional crude producers (fracking) have the ability to halt production in a short amount of time (1-3 days) and restart without loss of produced volumes, their debt puts them in a precarious situation. Oil produced is used to pay down debt and credit lines. As they deal with the lack of demand and high storage costs, bankruptcies will be inevitable for those without cash reserves to weather the storm.

Relief at this point has been running out of solutions. The Government’s option to buy crude for the SPR has been eliminated. An alternative would be to offer the available storage in the SPR on leased terms. This would create storage space and if the Government can discount the lease terms, it may be a near term solution to support US oil woes. Another alternative is to issue tariffs on imported crude oil, but that may not be welcomed by the global community. Many contracts are already in place and it may defer the pressure to refiners.

Without a doubt, the oil industry will need to deal with supply, demand, debt and bankruptcies ahead.”

Data: Refinitiv Eikon

Commentary: Carl Larry, Market Development Director, Refinitiv