Battery Storage, Smart Grid, and Efficiency Companies Raise Over $1.7 Billion in VC Funding in 1H 2019 Reports Mercom Capital Group

Austin, Texas – Mercom Capital Group, LLC, a global clean energy communications and consulting firm, released its report on funding and mergers and acquisitions (M&A) activity for the global Battery Storage, Smart Grid, and Energy Efficiency sectors for the second quarter (Q2) and first half (1H) of 2019.

To get a copy of the report, visit: https://mercomcapital.com/product/q2-2019-funding-and-ma-report-for-storage-grid-efficiency

Total corporate funding (including venture capital funding, public market, and debt financing) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2019 was flat with $2.3 billion compared to $2.4 billion raised in 1H 2018, a four percent decrease year-over-year (YoY). The decline in funding in 1H 2019 was due to lower funding activity in Smart Grid companies, while funding increased in the Battery Storage and Efficiency sectors.

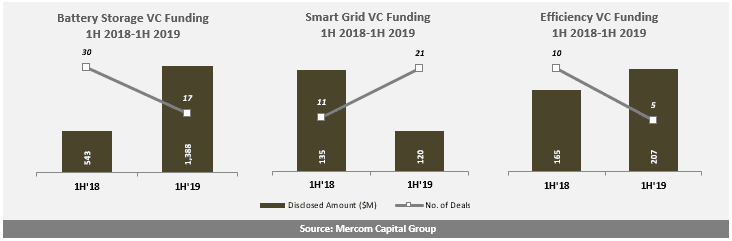

Chart: Battery Storage, Smart Grid, and Efficiency VC Funding in 1H 2019

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2019 was 102% higher with $1.7 billion compared to over $843 million in 1H 2018.

Chart: Battery Storage, Smart Grid, and Efficiency Top VC Funded Deals in 1H 2019

Battery Storage

VC funding in Battery Storage companies in 1H 2019 was up by 139% with $1.4 billion in 17 deals compared to the $543 million in 30 deals in 1H 2018. The increase was spurred by Northvolt’s $1 billion funding round.

The Top 5 VC funding deals in 1H 2019 were: Northvolt’s $1 billion raise, Sila Nanotechnologies raised $170 million, Romeo Power secured $88.6 million, Zenobe Energy secured $32.3 million, and LivGuard Energy Technologies raised ~$32 million. A total of 41 VC investors participated in Battery Storage funding in 1H 2019.

Announced debt and public market financing activity in the first half of 2019 ($547 million in five deals) was 275% higher compared to the first half of 2018 when $146 million was raised in six deals.

There were four announced Battery Storage project funding deals in 1H 2019 bringing for a combined $499 million compared to $34 million in four deals in 1H 2018.

In 1H 2019 there were a total of six (one disclosed) Battery Storage M&A transactions, compared to eight transactions (two disclosed) in 1H 2018.

Smart Grid

VC funding in Smart Grid companies in 1H 2019 was 11% lower with $120 million compared to the $135 million raised in 1H 2018.

The Top 5 VC funding deals in 1H 2019 were: SmartRent raised $32 million, CleanSpark raised $20 million, Innowatts received $18.2 million, Wirepas raised $16.2 million, and Driivz raised $12 million. A total of 48 VC investors participated in Smart Grid funding in 1H 2019.

Announced debt and public market financing for Smart Grid companies came to $1 million in one deal in 1H 2019 compared to $1.3 billion in two deals in 1H 2018.

In 1H 2019, there were a total of 17 Smart Grid M&A transactions (one disclosed), compared to five transactions (all undisclosed) in 1H 2018. There were eight Smart Grid M&A transactions (all undisclosed) in Q2 2019. By comparison, there were nine Smart Grid M&A transactions (one disclosed) in Q1 2019 and four transactions (all undisclosed) in Q2 2018.

Efficiency

VC funding for Energy Efficiency companies in 1H 2019 was 25% higher with $207 million compared to the $165 million raised in 1H 2018.

The Top 5 VC funding deals in 1H 2019 were: Kinestral Technologies raised $100 million, Budderfly raised $55 million, Carbon Lighthouse secured $32.6 million, and METRON received $11.3 million. A total of 18 VC investors participated in Energy Efficiency funding in 1H 2019.

Announced debt and public market financing activity in the first half of 2019 ($56 million in two deals) was 74% lower compared to 1H 2018 when $212 million was raised in two deals.

In 1H 2019 there were a total of eight Efficiency M&A transactions (two disclosed), compared to three transactions (all undisclosed) in 1H 2018. There were seven Efficiency M&A transactions (one disclosed) in Q2 2019. By comparison, there was one disclosed Efficiency M&A transaction in Q1 2019 and two undisclosed M&A transactions in Q2 2018.

Chart: Battery Storage, Smart Grid, and Efficiency Disclosed M&A Transactions in 1H 2019

Utilities and oil and gas companies have continued to actively acquire companies in this space.

Chart: Acquisitions by Oil/Gas Companies and Utilities in 1H 2019

To get a copy of the report, visit: https://mercomcapital.com/product/q2-2019-funding-and-ma-report-for-storage-grid-efficiency

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Battery Storage, Smart Grid and Energy Efficiency, and Solar, and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com. Mercom’s clean energy reports: http://store.mercom.mercomcapital.com/page/.