Saudi Aramco-Sabic Deal Helps Citi Retain Top Position in GlobalData’s M&A Financial Advisers League Table in Oil & Gas Sector

Citi has retained the top position in the latest mergers and acquisitions (M&A) league table of the top 10 financial advisers for the oil & gas sector based on deal value for the first quarter (Q1) 2019, according to GlobalData, a leading data and analytics company.

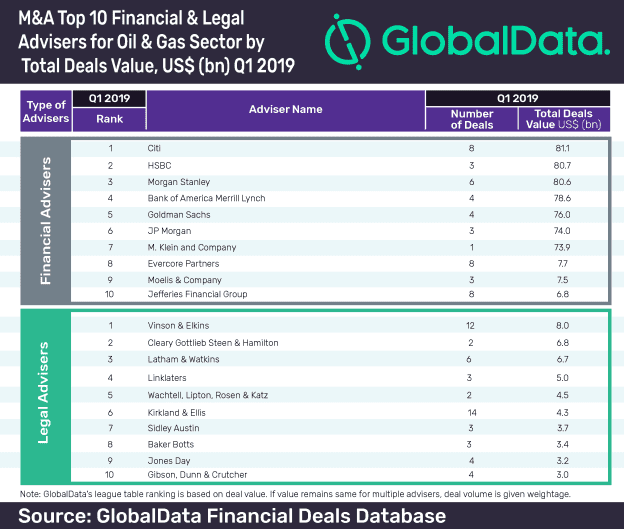

The American multinational investment bank topped the rankings with a deal value of US$81.1bn, by advising on eight deals during the quarter, which incidentally was the highest in terms of volume (a figure shared by two others). HSBC was a close second with US$80.7bn earned on the strength of just three deals.

According to GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world to compile the league table, Morgan Stanley took third place with six deals worth a total of US$80.6bn.

Praveen Karnati, Financial Deals Analyst at GlobalData, says: “Citi retained its top position mainly by advising Saudi Basic Industries (Sabic) in its 70% stake sale to Saudi Aramco for approximately US$73.9bn.”

Global oil & gas deals market in Q1 2019

The oil & gas sector saw an increase in deal value by over 45.9% from US$109.6bn in Q1 2018 to US$159.97bn in Q1 2019. However, deal volume declined by 14.7% from 654 in Q1 2018 to 558 in Q1 2019.

Sixth-placed JP Morgan topped the global league table of top 20 M&A financial advisers released by GlobalData recently. A somewhat similar leap was made by fifth-placed Goldman Sachs, which jumped to second place in the global top 20 list.

Vinson & Elkins leads top 10 M&A legal advisers list

Vinson & Elkins led the top 10 legal advisers table for Q1 2019 with a total deal value of US$8.0bn. Second ranked Cleary Gottlieb Steen & Hamilton showed a total deal value of US$6.8bn on the strength of just two deals – the least in the top 10 list. Latham & Watkins came in a close third with US$6.7bn although it took six deals to get there.

Top 10 leader Vinson & Elkins was conspicuous by its absence in the global league table of top 20 M&A legal advisers released by GlobalData recently. Cleary Gottlieb Steen & Hamilton, however, managed tenth position in the global list.

ENDS

For more information

To gain access to our latest press releases: GlobalData Media Centre

Analysts available for comment. Please contact the GlobalData Press Office:

EMEA & Americas: +44 (0)207 832 4399

Asia-Pacific: +91 40 6616 6809

Email: [email protected]

For expert analysis on developments in your industry, please connect with us on:

GlobalData | LinkedIn | Twitter

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including advisor names.

To ensure further robustness to the data, the company also seeks submissions from leading advisors, through an advisor submission forms on GlobalData, which allows both legal and financial advisors to submit their deal details.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.