Executive Corner: The Latest Trends in A/E Stock Valuation and M&A Pricing

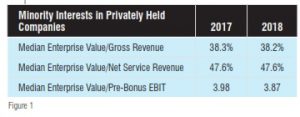

Rusk O’Brien Gido + Partners, LLC recently released its annually updated ”A/E Business Valuation and M&A Transactions Study.” Data from the sixth-edition study show remarkable stability in valuations of minority interests in privately held A/E and environmental consulting firms. As illustrated in Figure 1, enterprise values as a multiple of gross revenue, net service revenue, and pre-bonus earnings before interest and taxes (EBIT) were virtually unchanged from 2017 to 2018.

This is not too surprising given the general economic stability in the United States, similar interest rate environment and steady financial performance across the industry. The study shows that key financial performance metrics such as labor multiplier, labor utilization (billability) and overhead rate across the industry were very consistent from the prior year. In short, firms in the A/E and environmental consulting industry posted consistently strong financial performance, with fully utilized labor resources, good demand for their services and healthy profit margins. Anecdotally, the most commonly cited concern among firm leaders was the difficulty in recruiting and retaining talented and experienced staff.

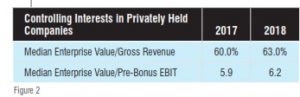

Steady economic conditions have also continued to drive merger and acquisition (M&A) activity. The volume of M&A transactions in 2018 was up considerably from the prior years. Our tracking data indicates that 311 mergers or acquisitions were closed in 2018 vs. 250 in 2017 and 253 in 2016. This increase in deal activity appears to have had a slightly positive impact on deal valuations and structure. Our sixth edition of the study shows that median valuations as a percentage of revenue and as a multiple of EBIT both increased in 2018 (see Figure 2).

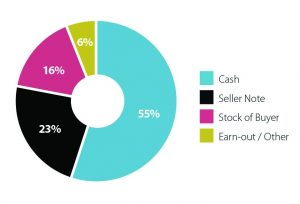

Deal structures shifted slightly as well, with less “at risk” consideration in the form of earn-outs and other contingent payments. Chart 1 illustrates the overall breakdown of consideration paid from the latest study.

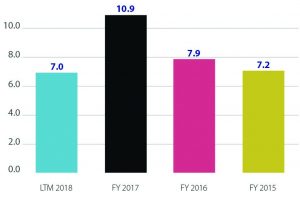

At the same time, valuations of publicly traded firms have fallen back to historical norms after a spike at year-end 2017. Valuations for many publicly traded firms hit a high point relative to revenue and earnings at that time in anticipation of corporate tax reform and a potential infrastructure spending bill. Chart 2 shows the historical enterprise value as a multiple of EBITDA for the combined 11 publicly traded A/E and environmental consulting firms (weighted by revenue levels) tracked by the study.

The “A/E Business Valuation and M&A Transactions Study (6th Edition)” contains 10 valuation multiples calculated and broken down by firm type and detailed by statistical median, mean, trimmed mean, upper and lower quartile. It includes data on privately held firms, ESOP-sponsoring companies, publicly traded firms, and M&A transactions. The study also contains a statistical analysis of 19 distinct financial condition and operating metrics.

The study is available for purchase at rog-partners.com/aestudy/.

About Ian Rusk

Ian Rusk, Managing Principal of Rusk O’Brien Gido + Partners, has spent the last 20 years working with hundreds of architecture, engineering and environmental-consulting firms large and small throughout the United States and abroad, with a focus on ownership planning, business valuation, ESOP advisory services, mergers and acquisitions, and strategic planning.