Federated GIS Based on Bentley Map Enables Cancún to Collect 66 Percent More Property Tax

Bentley Channel Partner Innovacion Sistemas y Proyectos (iSP) is a leading provider of geospatial information systems (GIS) services to local, state, and federal governments as well as the pharmaceutical industry in Mexico. The City of Cancún retained iSP to modernize its cadastral information systems and increase property tax collection revenue. By creating a federated GIS built on Bentley Map, iSP enabled various departments to access accurate cadastre and cartography data. The federated GIS improved the City’s approach to property tax assessment, enabling the collection of 18 percent more tax revenue within six months and 66 percent by the end of the first year. The City quickly recouped its investment, which represented 10 percent of one year’s tax collection revenue. In one year alone, the City expected to generate a total of USD 12.2 million in additional revenue for government services that will be used to improve quality of life for its citizens.

Tax Collection Shortfall

As one of the most popular travel destinations in Mexico if not the world, Cancún strives to continually improve the government services it provides to a growing number of citizens and tourists. The challenge is to leverage the City’s limited financial and personnel resources to achieve the best quality of life. Cancún is just one of 2,457 municipalities in Mexico that depend on the federal government for 71 percent of their revenue. The remaining 29 percent of revenue comes from tax collection – most importantly, property tax collection. However, because in many cases their tax collection systems are not yet fully modernized, municipalities in Mexico often take in less revenue than municipalities in other regions of Latin America, and far less than Europe and North America.

In Cancún, one aspect of the property tax collection system that required modernization was the maintenance of existing land and building property records, as well as the creation of new records for areas under construction within the municipality. Cartography comprised more than 28,000 non-linked files with geo-reference and restitution errors, and incorrect or non-existent cadastre keys. Modernizing the system required working with roughly 2.2 million entries of cadastral data.

Another constraint on the municipality’s tax collection performance was the fact that each department maintained its own information system. As a result, data and records were inconsistent in quality, format, and accuracy. Various software applications were used for database management and CAD document management. These variances hindered interdepartmental cooperation.

Developing the Cancún GIS

iSP developed the Cancún Federated Geospatial Information System to modernize the municipality’s cadastral system, and allow different departments to access and update property records. The USD 1.2 million project implemented Bentley Map, ProjectWise, and MicroStation.

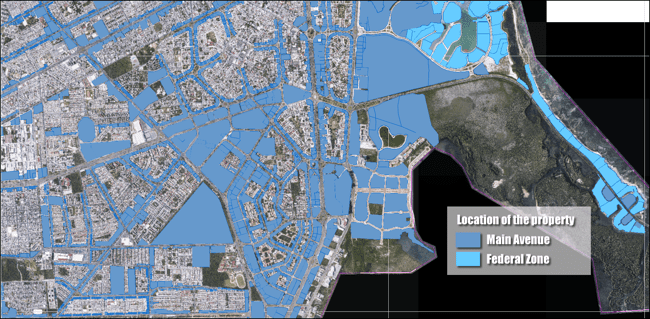

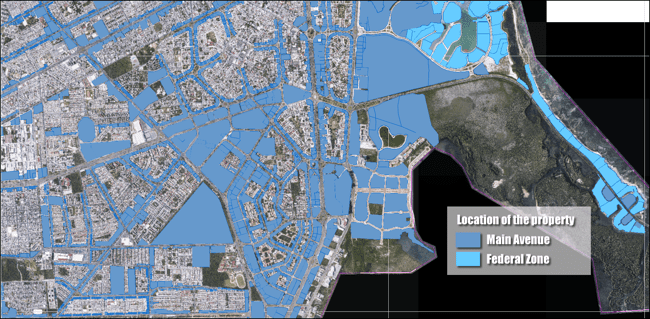

In Stage 1 of the two-year project, iSP updated land and building property records, created new construction records, and integrated departmental data into a single cadastral information system. This involved cleaning the data, taking aerial photography of the municipality, and developing photogrammetric restitution maps using the cadastre module of Bentley Map. Aerial photography of 156 square kilometers revealed new construction that had not been reported to the government and had not been subject to appropriate taxation.

The City also conducted a door-to-door census of the entire municipality using mobile devices to capture geo-coordinates, current property data, and images. The next phase integrated data from each of the municipality’s information systems into a single Bentley Map desktop GIS. The integrated system provided one-stop access to cadastral, contour, and statistical maps; aerial photography; asset images; and construction activities. Bentley technology allowed the City to update property information, identify merged lots, recognize new properties and unrecorded construction projects, and discover properties with unreported development.

In Stage 2, iSP set up ProjectWise access for the entire municipal organization. Using a common engineering information management platform standardized the entering, recording, retrieval, and reproduction of information such as Property Tax Office records. ProjectWise also facilitated collaboration among departments.

Accurate Data Enables More Effective Operations

The Bentley solution enabled the City of Cancún to standardize on one platform throughout the municipal organization. The Urban Development Office and Property Tax Office now use the federated GIS to assess property and building taxes in a consistent, accurate, equitable, and predictable manner. The municipality can now perform accurate analytics on a complete set of cadastre information and cartographic databases. Having access to up-to-date, single-source of data allows department personnel to better manage information such as property and building descriptions, ownership records, and assessed property values.

With better data management comes more effective operations. The City has been able to identify properties and new construction that were not previously listed in the tax database, or that were not correctly described. These property listings have been corrected or added to the database so the record accurately reflects the level of construction or development. For example, one property owner had paid taxes at a rate equivalent to that for an undeveloped lot, when in fact the property had a fully constructed three-story building. Such deficiencies in the system were quickly identified, and the offices that use the data were able to cooperate, provide clarifications, and submit additional information.

As a result of these improvements, the municipality’s two most critical business units—Urban Development and Property Tax—have streamlined their operations, and become more efficient and productive.

Expected Revenue Increases

The improved approach to property and building tax assessment increased tax collection revenue by 18 percent in just six months—providing USD 3.3 million in additional revenue for government services. Within the first year of operation using the federated GIS, the City expected to increase property tax collection by 66 percent for an increase in revenue of USD 12.2 million. In one year, the City will have recouped its investment in a federated GIS, which represented just 10 percent of the expected tax collection revenue.

Developed under the supervision of the National Institute of Statistics, Geography and Informatics (INEGI), Cancún’s federated GIS has potential application throughout Mexico, where unreported construction often costs municipalities millions in lost tax revenue. Bentley technology will enable local governments to detect discrepancies in property data that indicate owners are not paying the appropriate amount of taxes. iSP has already begun working with four municipalities to implement Bentley technology and improve their property tax collection systems.

About Cathy Chatfield-Taylor

Cathy Chatfield-Taylor is a freelance writer and principal of CC-T Unlimited, specializing in trend stories, case studies, and white papers about technology solutions for the AEC industry.