One of the most active advocacy groups for transportation infrastructure investments is calling on Congress to build a new long-term funding package around new types of fees on freight movements on the nation’s highway system.

In a July 17 letter to Senate Finance Chairman Orrin Hatch, R-Utah, and ranking member Ron Wyden, D-Ore., American Road & Transportation Builders Association President Pete Ruane urged lawmakers to include dedicated revenues to stabilize the Highway Trust Fund for the long term.

Specifically, he said, “ARTBA supports a comprehensive transportation tax and revenue reform package that is built around the freight fee concept.” Currently, the trust fund’s dedicated revenue comes mostly from per-gallon excises taxes on gasoline and diesel fuel, supplemented by taxes on other motor fuels and on trucking equipment.

While some have proposed providing the HTF a funding infusion through tax reform by diverting some taxes on a portion of any repatriated foreign earnings to pay for transportation projects, Ruane said road builders would consider that a temporary fix instead of a long-term solution.

“By long-term solution,” he wrote, “we do not mean a four- to six-year patch from repatriated overseas profits of a few large companies or some other one-off mechanisms.

“After more than $140 billion in general fund transfers to the HTF since 2008, it is time to end short-term thinking that just creates another revenue crisis for a future Congress to solve. We need a sustainable funding solution to put this critical national program back on solid footing for the next decade.”

The American Association of State Highway and Transportation Officials has also called on Hatch and other congressional tax writers to provide an additional long-term revenue stream to the trust fund, and specifically urged his committee “to consider supporting taxes or user fees that provide additional receipts into the HTF.”

And AASHTO has long included potential fees on freight shipments in a list it provides of revenue options to improve surface transportation funding.

The ARTBA chief executive in his letter noted that “the root of the HTF problem is that the federal motor fuels tax rates have remained static for more than 20 years. Appropriately adjusting the fuels tax rates and then indexing them to inflation going forward as part of tax reform could stabilize the HTF for at least the next decade, according to fuel use forecasts from the U.S. Energy Information Agency. ARTBA has long supported such an approach.”

However, Ruane added that congressionally chartered commissions and others have different long-term funding options.

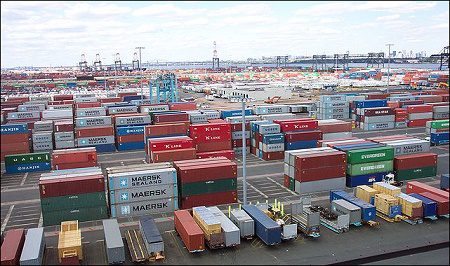

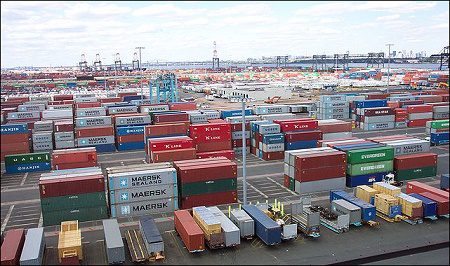

“We believe, for example, that a highway-based freight fee could be levied on the shipment of goods. The resulting revenue stream could be dedicated to HTF investments aimed at modernizing the National Highway Freight Network, which includes the Interstate Highway System and its links to the nation’s major ports, inland waterways, rail hubs, airports and pipelines.”

Ruane said that funding approach would also “provide direct user benefits to those paying the fee by funding capacity and operational improvements that could lower the cost of shipping freight.” And, “importantly, the revenue stream facilitated by such a fee would grow with the economy.”

The association CEO also emphasized that Congress needs to shore up the trust fund well before the five-year Fixing America’s Surface Transportation Act, which authorized and funded highway and transit programs, expires in 2020.

“Providing a permanent, sustainable revenue solution for the trust fund before 2019 should be a top tax reform priority,” he wrote.

Ruane explained that without funding certainty for the years after 2020, state departments of transportation could trim their transportation construction programs in advance.

“As we saw in the run-up to enactment of the FAST Act,” he said, “the states will start to react to uncertainty over future federal funding as early as 2019, pulling back on project lettings. This situation will put American jobs at risk.”

That view effectively puts lawmakers on a countdown, since Congress is now working on budgets for the 2018 fiscal year that starts Oct. 1 and would then soon attention turn to the fiscal 2019 budget cycle.

That effectively means congressional tax writers would have only about a year to pass a major tax reform that would also bolster the trust fund, or else the lack of long-term HTF funding could start to crimp project planning across the country.